The United States, Saudi Arabia, and Russia are the leading producers of oil in the world.

There are two major oil contracts that are closely watched by oil market participants. In North America, the benchmark for oil futures is West Texas Intermediate (WTI) crude, which trades on the New York Mercantile Exchange (NYMEX).17 In Europe, Africa, and the Middle East, the benchmark is North Sea Brent Crude, which trades on the Intercontinental Exchange (ICE).18Intercontinental Exchange. “Brent Crude Futures.”

While the two contracts move somewhat in unison, WTI is more sensitive to American economic developments, and Brent responds more to those in other countries.

……….

The Bottom Line

Crude oil, a vital and finite resource, plays a pivotal role in the global economy as the primary source of energy production and a key raw material for products like gasoline, diesel, and plastics. It is traded globally as a commodity, influenced heavily by supply-demand principles and geopolitical factors.

While the environmental impact of oil extraction and consumption is a concern, its importance persists as nations and industries depend on it for energy. Investors engage with crude oil through futures and spot markets to hedge, diversify portfolios, or speculate on price fluctuations. Despite its environmental controversies, crude oil’s significant role in energy production and economic activities underscores its indispensable status.

https://www.investopedia.com/terms/c/crude-oil.asp

Tragically, the Amazon forest in Brazil, after decades of destruction, is the latest casualty in oil production

Half a century of oil exploration has left the world’s largest rainforest scarred by deforestation, water contamination and air pollution. Indigenous lands have been infringed and economic disparities exacerbated. Now a new wave of drilling threatens to perpetuate this destructive legacy.

…………

The Amazon now holds nearly one-fifth of the world’s recently discovered oil and natural gas reserves, establishing itself as a new global frontier for the fossil fuel industry.

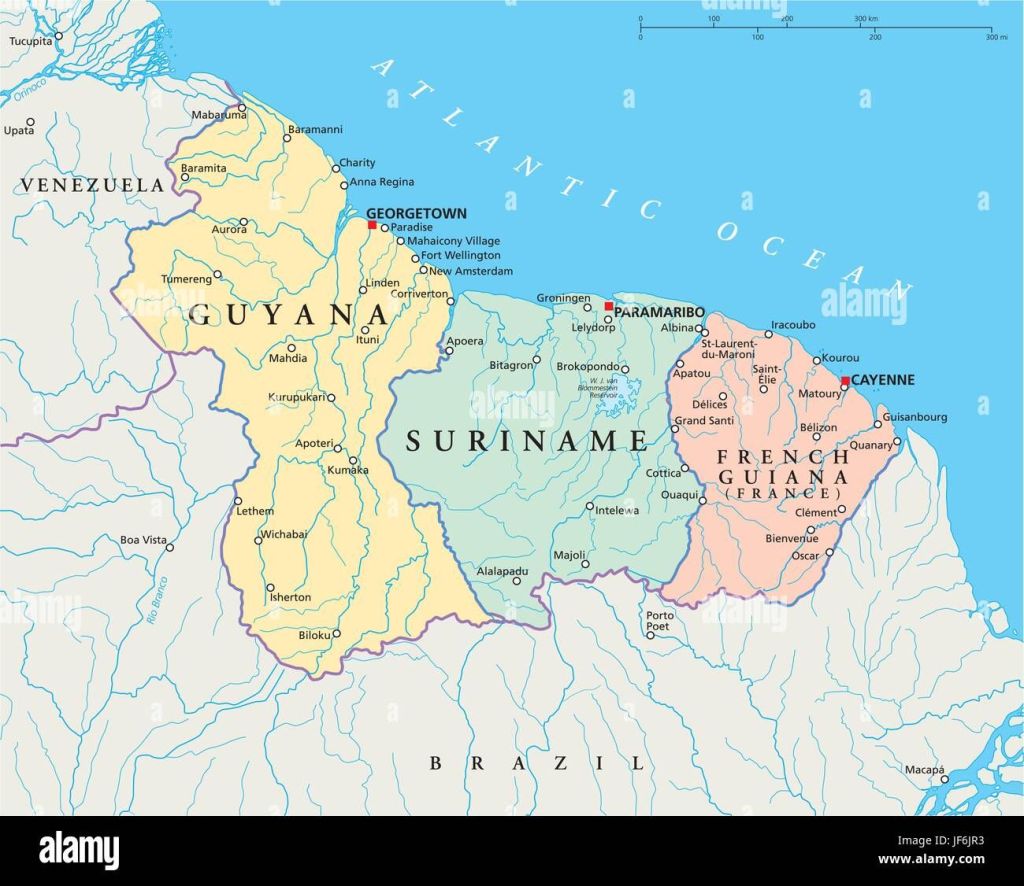

Almost 20 percent of global reserves identified between 2022 and 2024 are located in the region, primarily offshore along South America’s northern coast between Guyana and Suriname. This wealth has sparked increasing international interest from oil companies and neighboring countries like Brazil, which is looking to exploit its own coastal resources.

In total, the Amazon region accounts for 5.3 billion barrels of oil equivalent

A unit of measurement that converts energy sources into barrels of oil.

In total, the Amazon region accounts for 5.3 billion barrels of oil equivalent (boe) of around 25 billion discovered worldwide during this period, according to our analysis of Global Energy Monitor data, which tracks energy infrastructure development globally.

And Guyana and Suriname are the locations of this newly found oil.

April 16, 2025, by Melisa Cavcic

Brazilian state-owned energy giant Petrobras has disclosed the arrival of a jack-up rig, owned by Borr Drilling, a UK-headquartered offshore drilling contractor, in Brazilian waters, where it will undertake well decommissioning activities at oil and gas assets off the coast of Brazil.

After Borr Drilling’s Arabia I jack-up rig won a four-year contract with Petrobras in Brazil, with a four-year unpriced option, the work was slated to begin in Q1 2025.

Venezuela was blessed, then cursed for finding the black gold on its land, see my blog:

https://borderslynn.com/2025/05/07/incarceration-and-gang-culture/

Crude oil is in finite supply. Humans have learned they can’t live without fossil fuels, but using them is accelerating emissions, heating the oceans and killing living things at a rapid rate.

Wars are being fought because of its finite nature.

You must be logged in to post a comment.